According to the Text What Is the Biggest Factor in Your Long-term Financial Well-being

What Is Financial Literacy?

Managing your coin is a personal skill that benefits you throughout your life – and not one that everybody learns. With money coming in and going out, with due dates and finance charges and fees attached to invoices and bills and with the overall responsibility of making the right decisions almost major purchases and investments consistently – it'due south daunting.

You would recall that because the stakes are then loftier that this would be a skill that gets taught in loftier school (or fifty-fifty earlier), but that'south not the case. Managing your ain money requires a central understanding of personal credit and a willingness to embrace personal responsibility. That is, you pay your bills in a timely manner and you don't drown yourself in debt. You accept the fact that sometimes you have to sacrifice immediate demands and desires for long-term proceeds.

You budget. You save. You protect your savings. When you spend, y'all spend wisely. When you make large purchases, you do so for things that are worthwhile.

You understand the difference betwixt good debt and bad debt. And you constantly pay attention to your overall portfolio — earnings, savings and investments. You too sympathize what yous don't know, and you lot ask for assist when yous demand it.

To exist financially literate means having the ability to not allow money – or the lack of information technology – go far the way of your happiness as you work difficult and build an American dream complete with a long and fulfilling retirement.

How to Manage Your Money

Handling your finances the right fashion should be a priority, and it should drive your daily spending and saving decisions. Personal finance experts advise taking the time to learn the basics, from how to manage a checking or debit account to how to pay your bills on time and build from there.

Managing your money demands constant attention to your spending and to your accounts and not living across your financial means.

Money in the Banking company

Developing financial acumen starts with opening a bank business relationship. Once you have a paycheck, set up straight deposit. This keeps your money secure and saves y'all from paying interest to cash accelerate companies which charge a percentage of your check.

Having a bank business relationship provides convenience, access to a option of benefits and safety. Checks and debit cards offering proof of payment so you have a record of transactions showing where your money goes. The FDIC insures money in a savings account for up to $250,000.

There are a number of options for the type of primary account for saving your paychecks. Well-nigh people choose a checking, debit or savings account or combination of those. These enable yous to set up automatic payments for monthly bills and offer the ease of non having to carry cash around. Each option comes with certain benefits and disadvantages. Evaluate the various overdraft, monthly, withdrawal and other maintenance fees accompanying account options.

Experts recommend yous accept a savings account which y'all tin can employ for handling unexpected financial expenses and emergencies, such as a broken arm, flat tire or hike in school tuition.

Choosing to but open a checking or savings account can be a poor choice, equally having the two types of accounts split helps distinguish betwixt coin available for immediate spending and reserves, intended to be kept for the long-term. Keeping all your money in a checking account means your savings are hands attainable and bachelor to spend. You will miss out on interest generated past a savings account.

With money in an account, you can start spending. This is where you need discretion. Learn to differentiate betwixt necessities and luxuries. For example, you demand to pay for your yearly dental cleaning, but y'all desire to beget the salon appointment. Take reward of mobile banking to go updates on how much you are spending and how much remains in your account.

The all-time manner to leverage the greenbacks you lot accept in your banking concern account volition be to start budgeting immediately.

Budgeting

1 of the first edifice blocks of a successful personal finance plan is the power to budget. Although it's like shooting fish in a barrel to sympathize, it's as well difficult to exercise because it requires a hard look in the mirror and a willingness to see what really stares back at you.

Budgeting requires that you analyze and, likely, modify your spending habits. Instead of your coin controlling you, you control your money. Develop habits to salvage, avoid fiscal crunch and maintain peace of listen.

A successful upkeep programme clearly defines:

- How to follow a monthly spending plan

- Ways for lowering your monthly bills

- How to handle accrued debt

- Debt pay-off options similar the snowball and barrage methods

- How to distinguish betwixt curt-term, medium and long-term goals

- A breakup of family needs

Financial Literacy & Personal Finance Basics

How do you get started budgeting? Uncomplicated: yous plunge right in. You lot need to encounter exactly how y'all're spending your money and identify where your financial holes are.

Some steps:

- 1. First tracking your monthly expenses

- In a notebook or a mobile app, write in every time you spend money. Be diligent about this, because information technology's easy to forget. This is the foundation for your budget.

- two. Place fixed and variable expenses

- Fixed expenses are ones that y'all have every calendar month: hire, mortgage, auto payment, electric, bill, water neb, student loan payment. Variable expenses are costs that go up and downwards each calendar month and ones that come and go – groceries, pet supplies, haircuts, concert tickets, etc.

- 3. Add together up the totals

- Afterward three months, calculate how much yous are spending, on average, per month. And look at the categories.

- 4. Written report your variable expenses

- This is where nigh people tend to overspend. Decide what gives you the well-nigh pleasure from these monthly expenses that yous experience these costs are worthwhile? And which ones can you lot really do without? Be honest, and start cutting. This is the beginning of the hard decisions.

- 5. Factor in savings

- A key part of budgeting is that yous should ever pay yourself first. That is, you should take a portion of every paycheck and put information technology into savings. This ane practice, if you can go far a habit, will pay dividends (literally in many cases) throughout your life.

- six. Now set your budget

- Start making the necessary cuts in your fixed and variable expenses. Decide what you want to save every week or every two weeks. The leftover money is how much you accept to live on.

Constructive budgeting demands that you are honest with yourself and put together a plan that you can actually follow. The more time and attempt you put into your budget today, the meliorate y'all will be able to maintain a life-long savings habit.

Credit or Debit?

In addition to cash and a bank account, most people own some type of plastic, like a debit bill of fare, credit bill of fare or combination of the two. What yous practise with these tools has serious repercussions on your ability to constitute credit history and to avoid developing a borrowing habit.

Conservative financial experts recommend either having simply a debit card or having both with the credit card reserved for occasional major payments and then immediately paid off. This communication is often given to people who have accrued a large amount of debt.

Starting out with one of each card can assist you lot develop responsible spending habits and provide convenience. Consider the rewards offered by both cards, specially if you travel or brand large purchases frequently.

The main advantage of merely using a debit card regularly is you lot spend money y'all already have. Debit cards tin be tied to your checking account where paychecks are automatically deposited.

Debit cards have benefits like no limit on the amount of transactions and rewards based on frequent use. You have the power to spend without carrying cash and the money is immediately withdrawn from your business relationship.

Considering using the card is so easy, it is vital that y'all don't overspend and lose track of how often you're spending with this account. If you're non paying attention, overdraft fees can drain your account.

Some hotels, car rental companies and other businesses require that you use a credit card. Getting an account designed for occasional use tin can be a wise determination. You can establish your credit history and take advantage of the fourth dimension buffer between making a purchase and paying your nib. Another advantage of using credit is the added protections offered by the issuer. For online shopping and larger purchases, a credit menu tin can be a safer selection than a debit card.

Relying on a credit card tin can pb to taking on serious debt. Should you lot choose to ain a credit card, the all-time method of action is paying in full every calendar month. It is likely you will already be paying interest on your purchases and the more fourth dimension you carry over a balance from calendar month to month, the more than interest yous volition pay.

Saving

Saving is an essential component of practiced budgeting. Using a savings business relationship allows you to prevent emergencies from draining the money you need for monthly bills and slowly build a reserve for making large future purchases. This reserve can be used for car repairs, apartment deposits, unplanned surgeries and other medical needs and even gathering funds for a domicile down payment.

Some facts nigh saving:

- 67 per centum of Americans have less than 6 months of expenses in savings.

- From 2011-2014, 24 to 28 percent of Americans had zip emergency savings.

- People ages 30 to 49 are the to the lowest degree likely to accept emergency savings.

- ane person out of every 5 people nearly retirement historic period has nada money saved.

Make a financial delivery that you tin can keep, even if it means starting small, like $l from every paycheck or cutting out your gym membership for an extra $100 a month. Remember, this account isn't for splurging on the latest Apple production or a Michael Kors bag. Be intentional about only using your savings for needs. Whenever y'all take money out, practice your best to chop-chop replenish the withdrawal.

Developing consequent savings habits allows you to leverage time, your age, your current resources, compounding involvement, investments and tax-advantaged savings.

Saving tips:

- DO set a portion of your paycheck to automatically go to savings.

- DON'T leave a savings account every bit your last financial priority.

Debt

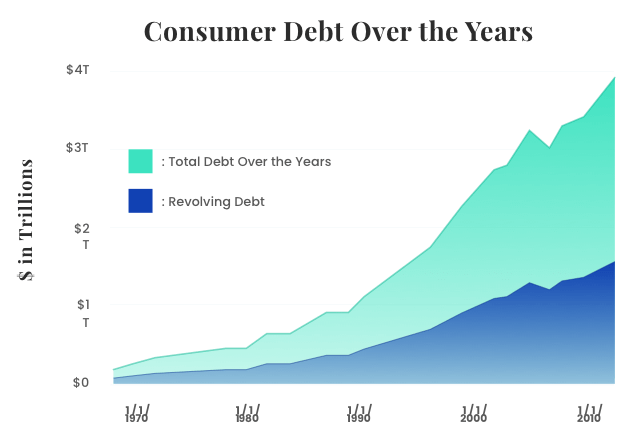

The trend of personal debt in America over the by four decades shows a slow simply steady climb.

A December 2014 Federal Reserve study revealed the boilerplate U.S. household has:

- $fifteen,611 in credit carte debt

- $155,192 in mortgage debt

- $32,264 in student loan debt

In Feb 2018, Experian released its annual national average VantageScore, a representative credit score, was 675, upward from 666 in 2014. All the same, information technology's much lower than the 800 rating that qualifies to get the best involvement rates when it comes time to buy a house or motorcar.

The study likewise said the average consumer has a credit-card residue of $six,354.

Expand

Total Debt for American Consumers = $11.74 trillion

Credit Scores

A credit score tin exist a strong indicator of your financial well-being. Equifax, Experian and TransUnion are the chief credit bureaus and assign scores ranging from 300 (loftier run a risk) to 850 (depression hazard). The bureaus make up one's mind scores based on a group of factors which reverberate your spending habits.

Never underestimate the importance of credit scores. Once you are spending coin with plastic and paying bills regularly, yous brainstorm your history. This tape of how often you borrow, how apace you repay and how much yous owe can follow yous throughout your life.

Credit Score Checklist

- Make certain you know where you stand and address the blemishes on your credit reports.

- You lot tin can obtain a re-create of your credit report for complimentary once every year from each of the credit bureaus.

Building a high credit score can assistance you get approving for depression-interest loans, credit cards, mortgages, and car payments. When y'all are looking to move into an apartment or get a new job, your credit history may exist a deciding factor.

On the other paw, making late payments on bills, missing payments, piling on debts and regularly maxing out your credit menu can result in seriously lowering your credit score. But every bit an excellent score can requite you access to loans, jobs and more than, a low credit score tin can prevent you from existence able to borrow more than, pay low interest rates and even get certain jobs.

Using Credit Responsibly

Using credit cards is a manner of life for well-nigh Americans. For some, information technology's a tool for building credit and borrowing coin for major purchases. For other, information technology's a constantly refilling debt relied on for nearly every buy.

How many credit cards do you have? Experian's eighth annual State of Credit Study, issued in February 2018, shows consumers have an boilerplate of 3 credit cards.

Learning how to apply these tools wisely has a major impact on your hereafter, as potential employers may review your credit history and credit scores can exist used to qualify you for better involvement rates when information technology comes to loans, mortgages and applying for more credit.

Choosing the Correct Card

Many credit cards require you meet a minimum credit score for approving. The higher your score, the more perks you will qualify for, like depression interest rates and a high credit limit. If you are a student you may authorize for special rates. Make up one's mind earlier y'all apply for a carte du jour what your plan for using the card volition be. Pay attention to introductory promotions which may elapse after 6 months to one year of owning a bill of fare.

Making a Game Plan for Credit Employ

Plan earlier yous spend. You can become a responsible credit bill of fare owner past marking your calendar to avert missing or being belatedly for paying credit bills. Another precaution against getting in a borrowing hole is making sure yous exercise not spend coin you cannot repay and keeping your rest well beneath the limit for your account. Ask questions. Are in that location points you will earn for regular use? Is the April affordable? What kind of limits will yous have? Find out what the fine print means earlier racking up debt y'all won't be able to repay.

Paying Off Credit Card Debt

Getting control of your credit card debt requires taking a proficient await at how much you lot owe. Take a deep breath and evaluate what you tin can beget. You probable will need to define a long-term strategy for chipping away at the total amount yous owe while ensuring you don't dig yourself deeper into debt. Talk to creditors to discover if they tin can work with you to make a programme that works. Merely expect into consolidation and settlement as a last resort.

Pupil Loans

Student loan debt is almost equally routine today every bit a automobile loan or credit-card debt. Few college graduates exit school without some sort of pupil loan to repay.

Virtually students don't ask if they'll go to college, only rather where they volition become. And it may not be until a few decisions subsequently that they consider how to afford tuition. Years subsequently, when school ends and real-world living begins, the afterthought of student loans takes its toll and the bills commencement rolling in.

Educatee Loan Facts

- xl million Americans take at least one outstanding educatee loan.

- Americans owe more than $one.2 trillion in student loans, making up 6 percent of the total national debt.

- The average borrower graduates from college owing $29,000.

Paying Attention to Loans While You're All the same in School

In add-on to signing the promissory note for your loans, take the time to examine exactly when your first payment will be due and how much information technology will be. Put that future date and price on paper and in the time between at present and so, begin saving money to repay your loans. If you can work a few hours during the week, on the weekends or just holidays and summers, you lot can begin your postal service-college years with a surplus of money that can become straight toward loans.

Practice's & Don'ts

- DO find out when your grace period ends.

- DON'T miss your first payment because you forgot to mark your calendar.

Staying in Control When Y'all Get out or Graduate

When the time to commencement paying comes, you have options for repayment. The Federal government offers longer term payment plans as well as graduated repayment options which allow you to bulk up your income and get some job feel under your belt earlier making larger monthly payments.

From there, your next step will exist making payments on time and reducing the principal if possible by paying more than the minimum that is due. For public service careers, you may authorize for loan forgiveness.

Practice's & Don'ts

- Practice brand more than the minimum payment to reduce your principle.

- DON'T skip payments or accrue late fees.

When Repayment Isn't an Option

During certain seasons of life, your income may exist severely limited and affording educatee loan payments merely isn't possible. Fortunately, loan servicers are aware that situations like this occur and have precautions in place to help students get through these difficult times. Qualifying circumstances, like unemployment or health bug, can make you eligible for deferment or forbearance, which allow you to temporarily postpone or reduce payments. Contact your loan servicers to find out your options. If you lot simply ignore loan bills, your account may receive delinquency or default status.

Do'south & Don'ts

- DO communicate with lenders if you are unable to brand payments.

- DON'T ignore student loans when you lot're struggling financially.

Real Estate

Owning property is a normal goal for a sound fiscal programme. Home ownership non only develops a sense of accomplishment and pride but also builds equity. It is besides a major financial undertaking and a long-term investment.

For many people, buying a home is the biggest buy they will e'er make. Unfortunately, more than and more than people find themselves forced to put off this buy. Student loan debt, underemployment, rising domicile prices and stringent mortgage standards prevent people from buying their own homes until subsequently in life.

Before signing a mortgage, make certain to calculate all costs and leave some savings untouched for after you buy. Home ownership often comes with a slew of added expenses similar taxes, insurance costs, emergencies and necessary repairs. You want to accept more enough to barely go far past. Frequently getting approval for a decent mortgage rate requires waiting a few more years to save upwardly for a larger down payment.

The planning phase before buying a house is lengthy. Prospective buyers work hard to become to a place where they can observe their permanent dwelling. The process is long and involved, demanding almost people to build upwardly their credit scores, save up for a downwards payment, commit to a stable job location, earn an income that qualifies for a large enough mortgage, choose a good realtor, notice a suitable place to live, observe a home inspector than have an offering accustomed.

Home Ownership in the United states of america

- The average home heir-apparent searches x weeks and views 10 homes.

- The median price of a single-family dwelling in 2018 was $261,600.

- The boilerplate toll of a new single-family unit home in 2018 was $299,400.

- In April of 2014, home ownership for all ages fell to 64.eight percentage, the lowest it's been since 1995.

Foreclosures and Short Sales

A foreclosure occurs when borrower cannot make mortgage payments and the lender is legally given the right to take possession of collateral property. A short auction occurs when profits from selling a home are less the than debt remaining on a mortgage. In this case, the lien holder often agrees to release the debtor of the remainder of the loan.

On the other side of this coin is an opportunity for buyers looking to purchase a home at a discounted rate. While it might take more than paperwork and some hoops working with a bank to get the sale approved, these homes can be discounted as much as $60,000 (RealtyTrac, a real estate information company). Take a dwelling house inspected before proceeding with the purchase as these may require extensive repairs, remodeling and insurance.

Business organisation Finance

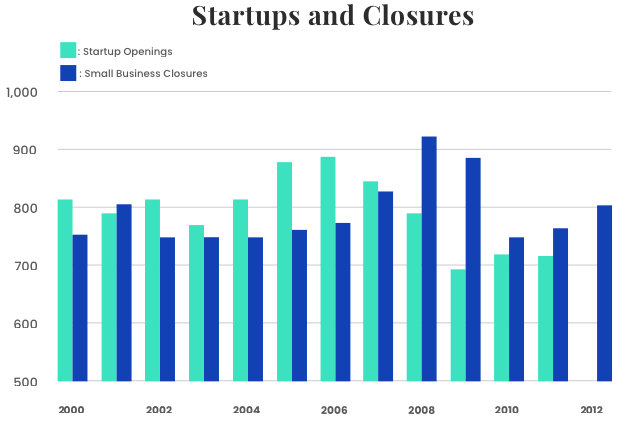

Startups are sweeping the nation. With the burgeoning tech industry and the DIY convenience of using the spider web as your storefront, entrepreneurial ventures take get commonplace. A University of Phoenix survey found 63 pct of adults in their 20s want to run their own businesses.

Small Business Facts

- Around 400,000 new businesses open up every year.

- The SBA defines small businesses equally those with less than 500 employees.

Top fastest growing sectors in 2014

- Electronic shopping and post-lodge houses

- Software publishers

- Calculator systems design and related services

Startups & Small-scale Concern

Business organisation owners utilize their own savings, loans, stocks and other sources for startup capital. It'south vital to research your manufacture and make a plan that describes exactly how you lot can maintain profitability. Some people rush into growing a business without properly vetting out a strategy for long-term success. Pursuing an heady business organisation idea and not considering all the costs involved tin make your dreams short-lived.

Startup Facts

- At that place are more than than 28 one thousand thousand small businesses in the United states.

- Ane tertiary of new businesses close within ii years, and half close within 5 years.

- The Small Business Administration reports that around 10 to 12 percent of modest businesses with employees shut every year.

After starting a business, the work has only begun. Staying competitive in your manufacture requires keeping an eye on trends and adapting to irresolute consumer demands. From evolving your marketing strategy to expanding your client reach the work of maintaining a business requires abiding dedication.

Expand

Startups and Business concern Closures Graph

| Share of Owners | ||

|---|---|---|

| Age | Under 35 35 to 49* l to 88* | 15.9 33.2 50.9 |

| Gender | Male Female | 64.0 36.0 |

| Race | White Not-white | 85.4 fourteen.6 |

| Ethnicity | Hispanic Non-Hispanic | x.3 89.7 |

| Veteran* | Veteran* Not-Veteran* | 9.1 xc.ix |

Venture Capital

One way entrepreneurs overcome their fiscal hurdles when starting out is by gathering venture capital, which refers to coin from investors hoping to profit from partial ownership and the long-term, high-potential growth of new companies.

This capital can be an essential tool for handling startup costs, equally a new business' size, assets and development phase can prevent it from chop-chop growing.

While banks may be unwilling to extend credit to companies without a significant track tape or collateral, angel investors and venture capital firms are oft willing to have a gamble on a new production or service. If in that location is a disarming pro forma, a detailed plan for operating the business, and then investors are more likely to take on the take a chance.

Retirement

The sooner you lot start saving for retirement, the more opportunities y'all volition have to grow the resource bachelor to you. The average lifespan has been steadily increasing. In the U.s., the boilerplate life expectancy is 78.74 years (Globe Depository financial institution). People are working later in life and living longer, both of which impact how much y'all will be able to save and how much y'all need to last your entire lifespan.

Your personal savings business relationship, bank, investment portfolio and employer can all be resources that help you set up for the future.

Retirement Facts

- The average age of retirement is 62.

- The average length of retirement is twenty years.

- Co-ordinate to the Center for Retirement Research, about a third of all households nearing retirement have no retirement savings.

Annuities and Retirement

People interested in adding security to their retirement portfolio often turn to annuities, which they can buy with one premium or with series of premiums. Insurance companies issuing annuities guarantee their payouts, hence the security appeal.

The other retirement reward that annuities have: their principal investment grows over time, and taxes get deferred until the investment starts paying out. The IRS taxes recipients on the almanac distribution rather than the value of the entire business relationship.

A secondary annuity market place exists also for people who want to shed their annuity or structured settlement immediately instead of waiting on it to pay off years from now. This marketplace allows annuity owners to cash out their contracts for money. The cash value for such a auction is less than it would be if an possessor held on to the investment, but even those who once wanted a retirement investment find themselves needing money at present and not after.

For instance, some people need to pay off unexpected medical bills or family unit emergency costs. Others want to pay off student loans – or are getting divorced and must make their long-term asset a liquid i. A seller can opt to sell some or all of their payments, using some money at present and saving the remainder for later income.

Get Your Free Guide to Annuities

Learn from the experts and become our 101-level guide, Annuities Explained, delivered to your inbox for complimentary.

Why an annuity for retirement?

- Anyone tin buy an annuity, and you can shop among a diverseness of them. You tin can get a contract that sets up distributions to be paid out immediately, in several months or years or in many years in the future.

- Options include a fixed annuity, which provides a stable payout, or variable investment, which fluctuates based on market changes. Owners can besides buy riders, such equally the ability to make early withdrawals or the guarantee that payments last throughout the possessor'due south entire lifespan.

View our glossary of key annuity terms

Getting Started

Begin by looking at how much you think you will need and planning a retirement budget. Fidelity financial corporation urges pre-retirees to have viii times their annual salary saved by retirement. This general guideline tin give y'all a rough idea of what you'll need, merely to get a clearer understanding take a look at each part of the picture.

Questions to inquire

- What age do you wait to stop working?

- Do you plan to work function-time during retirement?

- What kind of pre-existing health concerns will you need to embrace during retirement?

- What kind of retirement benefits does your company offer?

- Volition your company provide you with a alimony?

These are just a few examples of the questions you want to answer as your put together a retirement strategy. Use resources like the AARP website to find calculators for estimating expenses. Yous can learn about topics like how inflation volition bear upon the value of your money and how you can await your health cost to increment with age.

Do's & Don'ts

- DO consider downwardly-sizing and keeping the money y'all save to supplement retirement income.

- DON'T forget near 401(k) savings when you movement to a new job.

- DO decrease risks every bit you age, similar moving from stocks to bonds.

- DON'T put retirement savings as a depression-level priority just because it seems to be in the distant future.

Electric current Assets

Next await at the resource you lot already accept. It's never too early to start a saving business relationship. Even though your bank may offer accounts with low interest rates, you tin use the decades between now and retirement to slowly build your savings. Ane fashion to guarantee y'all are dedicating a portion of your income to retirement is to set upward automatic transfers straight from your paycheck into your savings.

Get an guess of your stock portfolio and how assets will mature by retirement historic period. Use taxation-advantaged accounts such equally IRAs and 401(thousand)southward. If your employer offers a friction match programme, endeavor to budget so that you can put in maximum contributions to get the virtually from this account. The value of 401(k)due south has been increasing in recent years, in part due to the stock market.

Looking into the Future

Evaluate other sources of retirement income. The Social Security Administration provides an estimator for determining how much your monthly Social Security payments will be. You will detect that the longer yous expect for Social Security payments (prior to full-retirement age), the more than your monthly payments will be.

If y'all're a veteran, teacher or other government worker, y'all may have pension payments you tin can count on. Your retirement benefits tin greatly vary depending on your occupation and employer. Make sure you are aware of and participating in any employer-offered retirement plans.

As you historic period, periodically gauge the value of your portfolio. You lot may need to accommodate your funds, accounting for market lows or stagnant investments. The older you are, the more than you volition want to put money toward chance-balky investments like bonds, rather than fluctuating stocks. Additionally, if you autumn backside in your retirement account deposits, you may authorize for larger catch-up contributions which would typically be more than the yearly maximum.

This guide can help you measure your savings progress.

Timeline for Retirement

- At age 50

Begin making grab-up contributions, an extra corporeality that those over l can add, to 401(k) and other retirement accounts.

- At 59½

No more tax penalties on withdrawals from retirement accounts, but leaving money in means more time for it to abound.

- At 62

The minimum age to receive Social Security benefits, merely delaying ways a bigger monthly benefit.

- At 65

Eligible for Medicare

- At 66

Eligible for full Social Security benefits if born betwixt 1943 and 1954.

- At 72

Start taking minimum withdrawals from most retirement accounts past this historic period; otherwise, you lot may be charged heavy revenue enhancement penalties in the future.

Source: https://www.annuity.org/financial-literacy/

0 Response to "According to the Text What Is the Biggest Factor in Your Long-term Financial Well-being"

Postar um comentário